Financial Statement Series

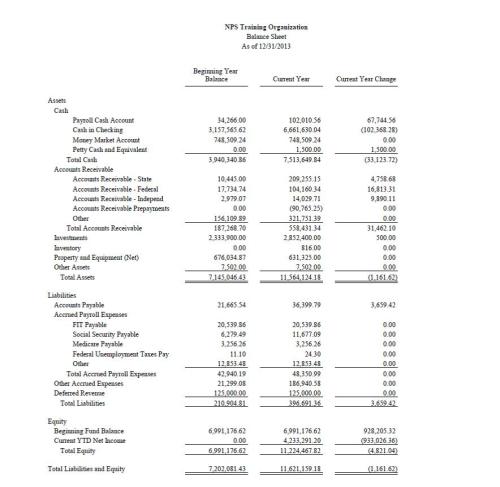

The statement of financial position required for nonprofits by FASB Statement 117 is similar to the balance sheet which we discussed in a previous article in this series. The statement of financial position addresses the restriction in net assets that the balance sheet does not. The balance equation is still the same:

Assets=Liabilities + Net Assets

This statement, like the balance sheet, lists assets in the order of liquidity, liabilities in the order that they are due, and the difference between the assets and the liabilities is the net assets.

Because nonprofits are funded by donors and other organizations such as grantors, donors may place restrictions on the contributions to the organization. Assets need not be reported on the basis of donor-imposed restriction unless they are designated for long-term purposes or received with donor-imposed restrictions that limit their use for long-term purposes. In those cases, there are guidelines for breaking out and reporting the assets designated for long-term use.

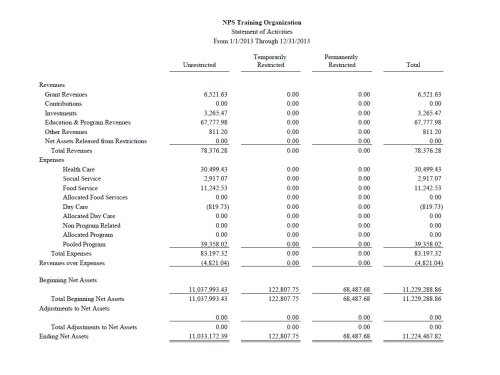

Net Asset Restrictions

Information about the nature and amounts of the restrictions on net assets may be reported by using a separate line for each type of restriction. Information on restrictions may also be included in the notes for the financial statements.

Permanently Restricted Net Assets

These are assets that the donor has instructed the organization to maintain in perpetuity.

Endowments are examples of permanently restricted net assets. Commonly, a donor contributes funds for an endowment with instructions that the principal may not be spent but the income generated by the endowment fund may be used by the organization.

Temporarily Restricted Net Assets

Temporarily restricted Net Assets either have a donor-imposed time or purpose restriction. Perhaps money is donated to a school for use within a specific school year. A building fund is another example of temporarily restricted funds.

Unrestricted Net Assets

These are net assets which have neither a permanent nor a temporary restriction placed on them. In the absence of donor restrictions, net assets are unrestricted.

Final Note

The statement of financial position offers unique insights into the special circumstances of a nonprofit organization. Looking at the statement balances, a reader might ask the following questions:

- Is there enough cash to pay the bills?

- Are investments diversified per organization policy?

- Are receivables being collected in a timely manner?

- Are vendors being paid in a timely manner?

- How long have liabilities been on the books?

- Are tax liabilities being met in a timely manner?

- Are the restricted funds protected?

A properly prepared statement of financial position is part of the complete package of financial statements for nonprofits.

Next time we’ll look at the statement of cash flows.

Trainer

Assets are important to your organization and help you accomplish your mission. Tracking those assets is just good management practice and provides for internal controls. Form 990 requires reporting on signification disposal of assets, but tracking asset information also helps you budget for replacement of those assets. Disposing of assets may have tax consequences, so it is important to record disposals correctly.

Assets are important to your organization and help you accomplish your mission. Tracking those assets is just good management practice and provides for internal controls. Form 990 requires reporting on signification disposal of assets, but tracking asset information also helps you budget for replacement of those assets. Disposing of assets may have tax consequences, so it is important to record disposals correctly.